About Unison

LOGIN TO UNISONStreamlined credit analysis and KYC Process with the support of a collaborative cloud platform leads to higher client satisfaction

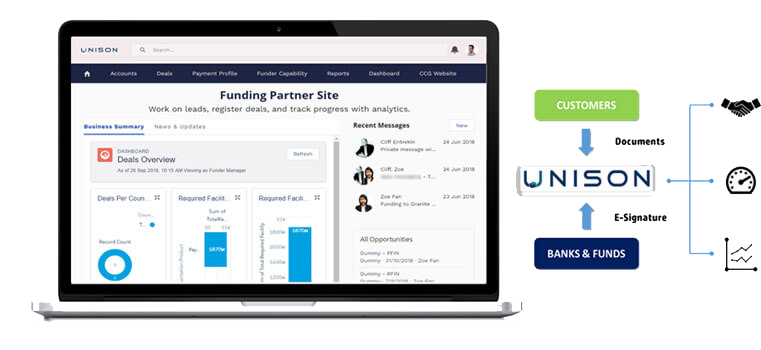

- Collaborative On-boarding: Cloud platform that links customers and funders together for credit analysis and KYC documents submission / approval

- Streamlined Process: Keep everything on the platform, no back-and-forth email communication. Reduces communication errors and saves time

- Real-time Tracking: Configurable Reports and Dashboards shows KYC operational metrics on a real-time basis

Efficient Onboarding

REQUEST A DEMOAccording to a recent survey*, 89% of corporate customers have not had a good KYC experience, and 13 percent have changed their financial institution relationship as a result. Increasing cost and complexity of KYC is clearly having a negative impact on funding institutions. Our Unison SM solution is the answer to the complicated KYC problems

ON-BOARDING TIME

24 Days

on average is observed to onboard a

new client. Up 22% from last year --

and anticipated to increase a further 18%

over the next year*

WITH UNISONTM

14 Days

to onboard a new client can be

achieved - Enhancing customer satisfaction

and reducing operating costs

*Thomson Reuters 2016 Know Your Customer Surveys

@ Copyright Convergence Trade Solutions PTE LTD. 2025. All Rights Reserved.Web Development Philippines |Privacy Policy