Invoice Financing for SMEs – A Better Way to Solve Cash Flow Without Taking on Debt

If you’re a business owner, you’ve probably faced this situation. You’ve shipped the goods. You’ve issued the invoice. But the payment? It’s still weeks or even months away.

Meanwhile, your suppliers want to be paid. Your staff need their salaries. And your next order is already waiting.

For many SMEs, especially exporters across Asia, this gap between delivery and payment creates constant pressure. It’s not that you don’t have orders. In fact, you might be growing. But growth without cash flow is like a car without fuel. It doesn’t move.

So what do most businesses do? They go to a bank.

And what do most banks say? Come back when you have more documents, more history, or more collateral.

That’s where many get stuck. But what if you didn’t need to take a loan at all?

You don’t always need a loan. You just need to get paid faster

Invoice financing for SMEs is a way to unlock the cash that’s already owed to you. Instead of waiting 30, 60, or 90 days for a buyer to pay, you can get paid within a few days after delivery. You’re not taking a loan. You’re not adding debt. You’re simply turning your invoice or purchase order into working capital.

That invoice is a promise to pay. A buyer has already agreed to the amount and due date. Invoice financing helps you access that money sooner.

And this is important. It’s not borrowing.

You don’t carry it as debt. You don’t need property as collateral. And you don’t pay interest in the usual way. You pay a small fee or discount and receive the cash when you need it most.

Why invoice financing is a game changer for SMEs

Let’s say you’re a furniture exporter in Central Java. You’ve just shipped a container of products to a buyer in France. The invoice says payment is due in 60 days. But your carpenters need wages. You also need to buy materials for your next order.

If you wait for that payment to arrive, your production slows. You may even turn down your next order.

But if you use that invoice to get funded now, your business keeps moving. You’re no longer stuck. You’re operating with confidence and control.

This is how invoice financing can turn a good business into a great one. It frees up working capital without increasing your liabilities or putting your assets at risk.

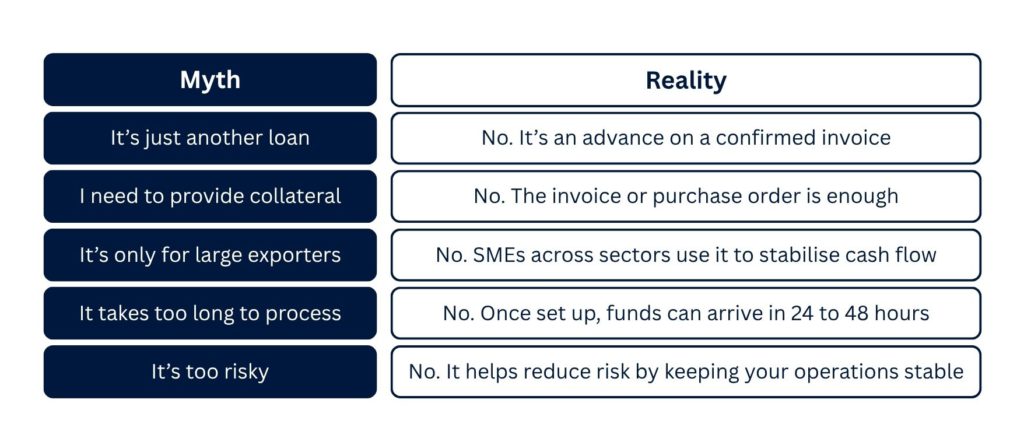

Common myths about invoice financing

Some SME owners still assume all financing means loans or high risk. But supply chain finance, especially invoice financing, works differently. Let’s clear up a few misconceptions.

Success story: From stuck to scaling in apparel exports

A large apparel exporter had steady orders from buyers in the US and Australia but faced up to 60-day payment terms. Their bank offered a credit line, and they had already fully utilised it. All available collateral had been pledged, leaving them with no additional borrowing capacity.

We stepped in to help them set up an invoice financing solution. Each time they shipped an order and issued an invoice, they could receive funding within 48 hours. This allowed them to keep raw material purchases going, pay their workers on time, and take on additional orders without delay.

In just a few months, they improved cash flow, stabilised their operations, and avoided the need to increase debt. Most importantly, they didn’t have to turn down new orders due to working capital constraints.

This is the kind of shift that invoice financing can create. It frees up capital already moving through the supply chain and gives exporters the breathing space they need to grow.

Who can benefit from invoice financing?

-

Exporters waiting on overseas payments

-

Suppliers dealing with long purchase order cycles

-

Distributors or traders balancing payables and receivables

-

Manufacturers funding operations while waiting for invoices to clear

If you’ve ever felt the squeeze between outgoing costs and incoming payments, invoice financing may be the simplest way to break the cycle.

What to do next

If your business needs working capital but you’re unsure about taking on debt, let’s talk. We’ll explain how invoice financing for SMEs works, what’s involved, and whether it fits your operations.

You don’t need to commit. Just start the conversation.

Get in touch today and take the first step toward better cash flow without the burden of a loan.

Previous Post Next Post